- Community Alpha by w3.hub Intern

- Posts

- I'm excited to reveal our investment in...

I'm excited to reveal our investment in...

Community Alpha Part 86

GMGM and welcome to Community Alpha Part 87, your history book that never stops writing history about the people who are currently making history.

The secret sauce behind truly good events

One of our portfolio projects is finally live

How to unlock the full potential of onchain lending

How to do cool events?

Too many events have turned into sales pitches. And honestly — that sucks.

So what does it actually take to create a community-centered experience?

→ Community ≠ Audience

Too many hosts think people are there to consume. A real community event makes guests part of the story, not people staring at their phones.

→ Timing matters

Starting late, dragging the agenda, no time left for conversations = wasted opportunity. Short, sharp, social is always better.

→ Depth over reach

I'd rather have 40 people who care than 400 who don’t. Curation beats mass-invites every single time.

→ Think beyond the stage

Great events don’t just happen up front. They happen in the side corners, over drinks, at the ping pong table. Build space for those micro-moments.

→ Don’t fake the vibe

If your event is basically a lead-gen funnel disguised as a “community night,” people feel it instantly. Authenticity is the only way people come back.

We believe we’ve poured all of that into a unique event format.

Bluerails is out of stealth

The team is building a programmable treasury layer that helps global businesses move money in, manage it, and pay out — across Europe, GCC and South Asia.

1/Cross-border finance deserves better. 🔷🚆

Today’s finance teams face a choice that shouldn’t exist.🎥 Our launch video ↓

— Bluerails (@bluerailsdotcom)

7:10 AM • Sep 2, 2025

With instant local payouts, compliant treasury tools, and cost-effective on-ramps, they’re solving real problems for finance teams.

We're proud to back this vision through w3.fund and excited to support the builders behind it.

How Twyne is fixing lending markets

A new launch is making waves across the Ethereum ecosystem: Twyne is live and it's taking aim at some of the biggest inefficiencies in today’s lending markets.

One of the minds behind it is a familiar face at w3.hub, but before we share that story, let’s take a closer look at what Twyne is building.

Your favorite lending market has 2 core problems. Today, we kill both of them.

Twyne is LIVE on Ethereum mainnet.

🧵

— twyne (@twynexyz)

3:30 PM • Sep 2, 2025

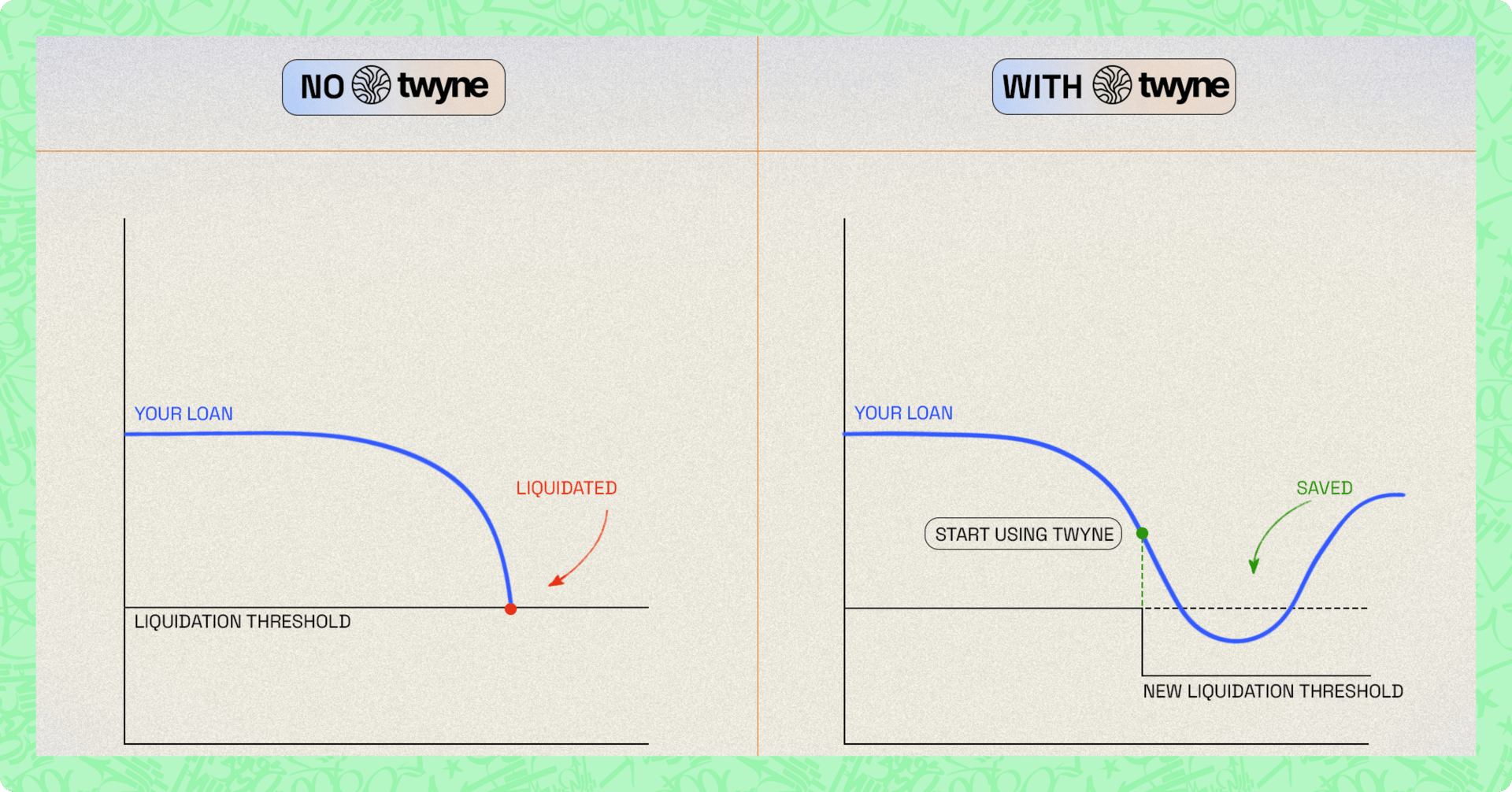

Today's lending markets suffer two core inefficiencies:

over half the lenders are idle, leaving money on the table

many borrowers are liquidated way too early

Instead of tackling them separate, Twyne makes these 2 problems solve each other.

Twyne lets lenders delegate their idle borrowing capacity to borrowers.

Lenders earn extra yield on unused credit

Borrowers reach higher liquidation LTVs

The result: more granular risk profiles, segregated exposure, while keeping liquidity aggregated on existing lending markets. Twyne just launched on Ethereum, try it out now.

Another cool app launched from w3.hub:

We've been working on something...

...the easiest and most fun way to trade on @HyperliquidX

— Binary Builders (@binary_builders)

2:08 PM • Sep 1, 2025

Never miss an event from us:

Hackathon season is back, w3.hub is packed, and innovation is in the air.

That’s it for today, thank you & lfg - w3.hub intern 🫡